First the not-so-good piece of news.

By construction, most existing credit models assume normality of asset-return distribution in order to be able to compute their Distance to Default and other related credit attributes.

But do we really leave in a normal world ? No comment…

What if an innovative and sophisticated structural credit model could provide all borrower credit attributes based on real life asset return distribution ?

That is exactly what we have achieved at Algosave.

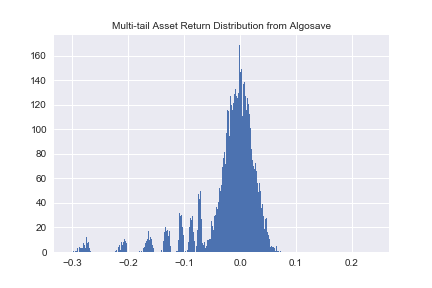

For instance, let’s examine Algosave latest forward-looking asset return distribution for a high grade global human resource and employment corporate borrower. Any hint of normality ? NOPE.

Now : the good piece of news.

This is the exact universe which Algosave FinTech uses in order to deliver all borrowers’ forward-looking credit attributes : multi-year, Point-in-Time, and scenario sensitive PDs and LGDs. Those are therefore based on a far richer and real-life set of possible scenarios than most current credit models.

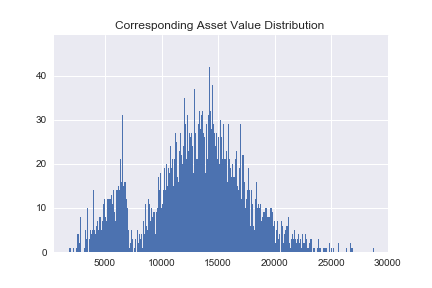

Ditto for the here-above corresponding Asset Value distribution. Watch the fat – fat – tail !

The many – many – tails we see on those distributions are hidden away from you in most existing credit models. And, unfortunately, that is also – and precisely – where the “action” may happen. But, for its clients, Algosave FinTech goes the extra-mile and shows the unseen risk : the risky forest behind the normal tree.

As a courtesy, should you want to see all Algosave deliverables – which of course, include those ones – on 1 or 2 specific borrowers, do not hesitate to leave me a note – here in the comments. We will send them to you with pleasure.